Activity ratio is the ratio that measures how effectively the company in utilizing all the resources that they have. All this activity involves a comparison of the ratio between the level of sales and investments in various types of assets. Ratio-the ratio of the activity assumes that there is a proper balance should between sales and diverse elements of assets such as inventory, fixed assets and other assets.

Assets that are low on certain sales levels will lead to the greater the excess funds assets. The excess funds will be better when embedded on other assets more productive.

The types of Activity Ratio

That is included in the ratio of activity is as follows:1. Total Assets Turn Over (assets turnover)

Total assets turn over is a comparison between the sales with a total assets of a company where this ratio illustrates the speed cycle all its total assets in a certain period.Total assets turn over is the ratio that indicates the level of efficiency of the use of the overall assets of the company in generating a certain volume of sales.

Total assets turn over is a ratio that illustrates the turnover assets measured from sales volume. So the larger this ratio the better which means that assets can be faster spins and grabs the spider and showed the increasingly efficient use of overall assets in generating sales. In other words, the amount of the same asset can enlarge sales volume if the assets turn over Yes enhanced or magnified.

Total assets turn over is important for the lender and the owner of the company, but will be more important for the management of the company, because it will show whether or not the use of the entire assets efficiently in the company.

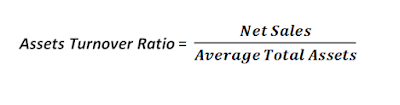

Total assets turn over is calculated as follows:

2. Working Capital Turn Over (Working Capital Turnover Ratio)

Working capital turnover is the comparison between sales with net working capital. Where the net working capital is current assets minus debt smoothly.

Working capital Turnover ratio is a measure of business activity against the excess of current assets over current liabilities and shows the number of sales (in Dollar) which can be obtained from the company for every rupiah in capital work.

Working capital turn over is the ability of working capital (net) rotating within a period of the cash cycle of the company.

Working capital is always in a State of operation or rotating within the company for the company in question in the State businesses. working capital turnover period (working capital turn over period) begins from the moment where cash invested in working capital components to which the time back into cash. The more short period means faster turnaround or cycle all its higher turn over rate (him). How long is the period of rotation of the working capital is depending on how long the period of rotation of each components of working capital.

Working capital Turnover is calculated by the formula:

Working capital Turnover ratio is a measure of business activity against the excess of current assets over current liabilities and shows the number of sales (in Dollar) which can be obtained from the company for every rupiah in capital work.

Working capital turn over is the ability of working capital (net) rotating within a period of the cash cycle of the company.

Working capital is always in a State of operation or rotating within the company for the company in question in the State businesses. working capital turnover period (working capital turn over period) begins from the moment where cash invested in working capital components to which the time back into cash. The more short period means faster turnaround or cycle all its higher turn over rate (him). How long is the period of rotation of the working capital is depending on how long the period of rotation of each components of working capital.

Working capital Turnover is calculated by the formula:

3. Turnover Ratio fixed assets (fixed assets turnover)

This ratio is a comparison between the sale with fixed assets. Fixed assets turn over measuring the effectiveness of the use of funds that are embedded on the treasure remains such as factories and equipment, in order to generate sales, or how the rupiah net sales generated by each dollar invested in fixed assets.

This ratio is useful to evaluate the company's ability to use its assets effectively to increase revenue. If the cycle all its slow (low), it is likely there is a capacity is too large or there are many fixed assets but less useful, or may be due to other such investment at halhal assets remains excessive compared to the rated output that will be retrieved. So the higher this ratio means more effective use of such fixed assets.

Rotation of the fixed assets is calculated by the formula:

This ratio is useful to evaluate the company's ability to use its assets effectively to increase revenue. If the cycle all its slow (low), it is likely there is a capacity is too large or there are many fixed assets but less useful, or may be due to other such investment at halhal assets remains excessive compared to the rated output that will be retrieved. So the higher this ratio means more effective use of such fixed assets.

Rotation of the fixed assets is calculated by the formula:

Fixed assets turnover

4. Inventory turnover Ratio (inventory turnover)

Inventory turnover indicates the ability of the Fund that are embedded in a rotating inventory within a certain period, or the liquidity of the inventory and the tendency for overstock.Inventory turnover Ratio

measures the efficiency of the management of inventory items. This ratio is an indication of a fairly popular for assessing operational efficiency, which shows how good the management control on capital stock.

There are two problems arising in the calculation of inventory turnover ratios and analysis. First, the sale of votes according to the market price (market price), the preparation of graded according to cost of goods sold (at Cost), then the actual ratio of inventory turnover (at cost) is used to measure the physical rotation inventory. Whereas the ratio is calculated by dividing sales by the inventory turnover inventory measure in cash.

However, many research institutions financial ratios that use inventory turnover ratio (at market) so if you want to compare with the industry's turnover ratio ratio of inventory (at market) We recommend that you use. Second, sales occur throughout the year while the inventory figure was the description of the circumstances of the moment. Therefore, it is better to use the average initial supplies namely inventory plus ending inventory is divided in two.

Inventory turnover Ratio

Calculated by the formula:Turnover ratio

5. The average age of accounts receivable

This ratio measures the efficiency of the processing of accounts receivable of the company, as well as indicate how long it will take to pay off debts or change accounts receivable into cash. The average age of these receivables is calculated by comparing the amount of accounts receivable by sales per day. Where a sale per day i.e. sales divided 360 or 365 days.Average accounts receivable can be formulated as follows:

The average age of accounts receivable

6. Accounts receivable Turnover

Accounts receivable that are owned by a single company has the contact closely with the volume of sales on credit. The position of accounts receivable and collection time estimates can be assessed by calculating the accounts receivable turnover rate by dividing the total credit sales (net) with average accounts receivable.Accounts receivable Turnover can be measured by the formula:

No comments:

Post a Comment