Debt to Equity Ratio (D/E) Definitions

The debt-to-equity ratio is a financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets. Closely related to leveraging, the ratio is also known as risk, gearing or leverage.

- Wikipedia

The ratio of Debt against Equity or Debt to Equity Ratio is the ratio of the debt and capital use to gauge the magnitude of the ratio. Debt to Equity Ratio is a ratio used to measure the level of use of debt to total shareholder's equity owned company.

A high debt to equity ratio indicates a business uses debt to finance its growth.

The debt-to-equity (D/E) ratio is calculated by dividing a company's total liabilities by its shareholder equity. These numbers are available on the balance sheet of a company's financial statements. The ratio is used to evaluate a company's financial leverage.

- Investopedia

Debt to Equity Ratio - Index

- Debt to Equity Ratio (D/E) Definitions

- Best Quotes for Debt to Equity Ratio

- Description (D/E)

- Debt Ratio Formula

- Debt to Equity Ratio formula

- Debt to equity ratio calculator

- Debt to equity ratio example

- What is a good debt to equity ratio?

- The variables Composing the Debt to Equity Ratio

- Ideal debt equity ratio

- Proprietary Ratio

- Proprietary Ratio Formula & Example

- Negative debt to equity ratio

- How to improve debt to equity ratio?

- Interest coverage ratio

- Major Indicators

- Conclusion

Best Quotes for Debt to Equity Ratio

The ratio of Debt against Equity or Debt to equity ratio is the ratio of the debt and capital use to gauge the magnitude of the ratio.

The ratio of Debt against Equity or Debt to equity ratio is a ratio used to measure the level of use of debt to total equity owned by the shareholder's company.

Debt ratio intended as the ability of a company to pay all its debts (either short term debt as well as long term debt)

Description (D/E)

Debt to Equity Ratio is a financial ratio is one that belongs to the Group solvency ratio. Debt to Equity Ratio is the ratio of the debt and capital use to gauge the magnitude of the ratio. Debt to Equity Ratio is a ratio used to measure the level of use of debt to total shareholder's equity owned company.

Debt to Equity Ratio indicates the percentage of the provision of funds by shareholders against lenders. The higher the ratio, the lower the corporate funding provided by shareholders. From the perspective of the ability to pay the long-term obligation, the lower the ratio the better will be the company's ability to pay in long-term obligations.

The higher total debt composition shows DER (short-term and long-term) is so large compared to the total capital on its own, so is impacting the bigger burden the company against outside parties (creditors). Increasing the load against the lender showing the source of capital the company depends very much with outside parties. Besides the debt burdens borne by the amount company can reduce the amount of profit earned company.

Debt Ratio Formula

The debt ratio is divided into three, among others:

A. The ratio of Debt to capital/ Debt to Equity Ratio (DER)

This ratio uses debt and capital to gauge the magnitude of the debt ratio referred to.

This ratio is calculated by the formula:

Leverage = (Total debt/Total Capital) x 100%

B. Capital adequacy Ratio/ Capital Adequacy Ratio (CAR)

This ratio indicates the specified capital adequacy regulatory agencies that apply specifically for industries that are under the supervision of the Government such as banks and insurers. This ratio is intended to assess the security and health of the capital company owner.

This ratio is calculated by the formula:

CAR = Stockholders Equity/Total Risk Weighted Assets

C. Ratio of Information capital (Capital Ratio Information)

This ratio measures a company's growth rate, especially in the company of the Bank so that it can survive without damaging Capital Adequacy Ratio. The larger this ratio then the stronger capital position.

This ratio is calculated by the formula:

Capital Information Ratio = net income Dividends paid/average Capital Owner

Based on the explanations above, it can be seen that the ratio-the ratio of above has a different function.

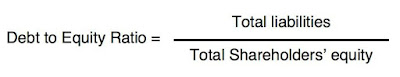

Debt to Equity Ratio Formula

This ratio is often also referred to as the ratio of Debt to capital. The ratio of forest against equity (DER) is a financial ratio calculates the total debt divided by total equity. Debt is a liability and equity is right, then the ratio of the debt against equity is the result of a division between the obligations and rights of the company. So, the total debt divided by total equity result was DER.

Debt to Equity Ratio effect negatively to profit growth. The ratio of Debt to capital/Debt to Equity Ratio (DER) is calculated by the formula:

DER = Total Debt /Total Equity (Capital) x 100%

The ratio of debt to equity of informing our shareholders and the relative amount of debt holders also that they contributed to the capital. It should be understood that this is a section for a comparison of the part and not part to the overall comparison.

Debt to equity ratio calculator

Calculate the ratio of debt to capital. Find the value of this ratio by dividing the total debt between with capital. Start with a section that has been identified in phase 1 and enter into the following formula:

The debt to capital Ratio = Total Debt ÷ Total capital. The result is the ratio of debt to capital.

For example,

Suppose a company has a long term interest debt totaling $ 150000.00. The company also has a total capital of $ 650000.

Thus, the company has a debt to capital ratio of 0.23 ($150000/$650000), which means that the total debt is 23% of the total capital.

Debt to equity ratio example

Based on the financial report of quarter II per 30 June 2018, excel-pmt.com, coded issuers SRIL has the duty or Liability of $700,68 million and equity (Equity) of $359,51 million. What is the Debt to Equity Ratio or DER excel-pmt.com?

Note:

Total Liabilities (liability) = US $700,68 million

in Total equity (Equity) = US $359,51 million

Debt to Equity Ratio (DER) =?

Answer:

Debt to Equity Ratio (DER) = Total Liabilities/Total Equity

Debt to Equity Ratio (DER) = US $700,68 million/US $359,51 million

Debt to Equity Ratio (DER) = 1.94 times

So the ratio of the debt against Equity or Debt to Equity Ratio. Three pillars of Prosperous Food per quarter II financial report June 30, 2018 is 1.18 times.

What is a good debt to equity ratio?

Debt to Equity Ratio (DER) with numbers below 1.00, indicating that the company has debt of capital (equity). But as investors we must also analyses in DER jelly, for if the total debt greater than equity, then we should see more smoothly or whether debt long-term debt:

- If the amount of the debt smoothly greater than long-term debt, it can still be accepted, because of the magnitude of debt is often caused by substandard operations that are short term.

- The long-term debt is larger, then the it company will experience impaired liquidity in the future. Moreover, the profit of the company is also increasingly stressed due to the need to finance the loan interest.

- Some of the companies that has DER above 1.00, disturbing growth performance of the company also interfere with the growth of its stock price. Therefore, most investors avoid companies that have more than 2 DER figures.

The variables Composing the Debt to Equity Ratio

A. Debt

The debt is all the financial obligations of the company to another party who is not yet fulfilled, where this debt is a source of funds or capital company originating from creditors. Debt can be distinguished into debt well and long term debt.

Debt Smoothly, is paying off debt or the payment will be made in the short term (one year from the date of the balance sheet) using current assets owned by the company.

Debt smoothly include:

- Trading Debt

- Tax Debt. The costs must still be paid

- Long-term Debt that will be maturing soon

- Income received in advance

Long-term Debt, are the financial obligations that the payout period (maturity) is still a long term (more than one year from the date of the balance sheet).

Long-term debt includes the following:

- Debt bonds

- Mortgages Debt.

- Other long term Loans.

B. Capital

A capital is right or part-owned by the company are shown in the heading capital (share capital), surplus and earnings on hold. The capital is the remaining rights over the assets of an institution after deducting its liabilities. Capital of a company may take the form of capital stock if for a limited liability company and individual capital for individual firms.

Ideal debt equity ratio

Debt to Equity Ratio (DER) can indicate or describe the effect on a lot of conditions. Connection with the investors, the effect on the dividend. The higher level of Debt to Equity Ratio (DER), meaning the composition of debt are also getting higher, so will result in increasingly low ability of the company to pay a Dividend Payout Ratio (DPR) to the shareholders, so the lower dividend payout ratio. DER has a negative influence against the House. DER high indicates that the majority of equity needs are met from the debt. A company paying off debt that matures by replacing other securities or pay using earnings withheld, the company moved forward to pay the debt.From the explanation above it can be concluded that the Debt to Equity Ratio as one of financial ratios can be the benchmark financial performance including measuring the level of use of debt to total shareholder's equity owned companies, Debt to Equity Ratio effect negatively to profit growth, as well as DER effect on dividends. DER has a negative influence against a Dividend Payout Ratio (DPR). DER high indicates that the majority of equity needs are met from the debt. However, it should be noted that the ratio of DER less suitable in the Belgian insurance and banks.

Proprietary Ratio

Proprietary Ratio (also known as Equity Ratio or the Net Worth to Total Assets Ratio) is the proportion of shareholders' funds to total assets. A high ratio will indicate that the firm has sufficient amount of equity to support the functions of the business.

Proprietary Ratio Formula & Example

Formula:

Proprietary Ratio = Shareholders funds / Total Assets

Or,

Proprietary Ratio = Shareholders' equity / Total tangible assets

(Note: Shareholder's funds include equity share capital and all reserves)

Example 1:

Excel-pmt.com has total shareholders’ funds of $2,200,000 and the total assets are $2,750,000. Then:

Equity Ratio = 2,200,000 / 2,750,000 = 0.8

This means that shareholders contribute 80 cents for every $1 employed in the business, with creditors contributing the remaining 20 cents.

Example 2:

Excel-pmt.com has shareholders' equity of $900,000 and total assets of $1,200,000 (including goodwill $200,000).

Then:

Total tangible assets = 1,200,000 - 200,000 = $1,000,000

Proprietary ratio = 900,000 / 1,000,000 = 0.9

Negative debt to equity ratio

If the indicator is less than 0.5 most of the assets of the company is financed with equity. If the ratio is greater than 0.5 most of the assets of the company is debt-financed. The higher the indicator value the higher the risk of loss by the company's ability to pay its debts (liquidity) if the creditors will demand immediate repayment of the debt.

In enterprises with extremely bad situation economic and financial debt ratio reaches a value greater than 1, which means that equity is negative.

A negative debt to Equity ratio denotes zero debt and company having a negative working capital. Excellent stock to buy if you can spot it. we need to distinguish negative "net debt / equity" from negative "gross debt / equity" as the interpretation could be very different.

How to improve debt to equity ratio?

Evaluate the company capital adequacy in financial institutions (banks) are assessing the stability of the company.

It is said that healthy companies covered by own funds than any other firm covered a lot of the necessary funds by borrowing money.

Means so to raise capital adequacy do is to (1) increase the shareholders ' equity, or (2) possible means of reducing the total capital it is.

How to be featured on this page is a money lending company executives, in other words, to improve the capital adequacy ratio can disappear due to debt relief officer loans on the company's financial results for the one. Also eliminated the loan officers think if loan officers will not actually pay a lot, tend to be small shareholders holding the national director’s family and virtually no economic loss that is not.

Not, of course, a loans officer can expect when Bank rating can be evaluated as part of the capital, but never appreciate that. In doing so, I think debt relief, increased the capital adequacy ratio clearly in any part of the earnings should be.

I think you may be concerned about the increase in the corporate income tax exemption of debts due, however, can improve the capital adequacy ratio, however, you can avoid tax at thinks from the aspect of the tax loss carry forwards under exemption of debts revenue be earmarked. If can escape from the State of insolvency due to the revenue, the parts on the evaluation of the financial aspects, it is so good that in also. Determine the tax and often talk about that or how much debt relief tax disadvantage to not.

Problem of debt relief loan officers gives affected by inheritance. You can reduce the amount of inheritance tax, reducing property taxes in case you do something officer assets receivables against company officers that will cease to exist. Do not intend to repay the original ones (or not pay) will be coming out may pay the tax amount is taxable inheritance tax as well gotten so caution is needed.

If you have accumulated deficit, how to improve capital adequacy ratios mentioned in this page, come again please consider. Is the method the tax ever supposes a very difficult problem, consideration?

Interest coverage ratio

Interest coverage ratio (times) = (operating income + interest and dividend income) / cost of goods sold.

It is used primarily to determine the creditworthiness of companies, know the company's interest coverage and interest coverage ratio indicators.

Is considered to be generally preferable that fits within the scope of our core business operating profit is interest. Interest coverage ratio, income interest that indicates how many times to a higher magnification for creditors as safe as possible. As this ratio leading indicators during the bond rating is used. Has become one of the indicators for determining whether or not, on the other hand, companies can increase to interest-bearing debt.

Major Indicators

Based on understanding and the formula, the ratio of debt against equity has two main indicators into objects of calculating the ratio.

Debt (Debt)

Debt is a liability of the company (the debtor) that must be satisfied or repaid to the giver of the debt (lender) in accordance with the agreement terminated. Agreement in the form of debt amount, interest rate, repayment period, and guarantees.

Equity (Equity)

Equity is the company's proprietary rights to all the net worth into assets of the company to perform the activity. The company's net worth consists of capital or stock of the owner of the company and profit withheld, without loans or debt capital to include others.

Basic Assumptions

The ratio of debt to equity measures the amount owed based on the figures listed in the balance sheet. Lately there are many ways to take on debt without it appearing in the balance sheet. The ratio of debt against equity is a measure that is very long and is not intended to take into account the complexity.Conclusion

Debt to equity ratio is the ratio of the debt against the equity of the company. This ratio indicates the percentage of the provision of funds by shareholders against giver loan the higher the ratio the lower funding companies that provided by the shareholders. From the perspective of the ability to pay long term obligation, the lower the ratio the better will be the ability

The higher total debt composition shows DER (short-term and long term) more than the total capital on its own, so impact the greater the burden the company against outside parties (creditors). Increasing the load against the creditor demonstrates the company's source of capital very hung with outside parties. Besides the debt burden the amount borne by the company can reduce the amount of profit earned company. Debt to equity ratio effect negatively to profit growth.

Net income to sales is the ratio of net profits against sales. An increase in the high net profit shows the condition of the company that is getting better. Due to the increased net profit shows company in conditions healthy. net income to sales a positive effect against profit growth.

No comments:

Post a Comment