There are several ways that can be use to classify the cost include:

Staple Function base on Company

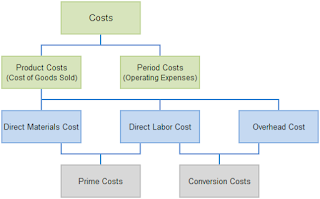

Factory Cost (cost of production)

- The Raw Material Costs (Direct Materials Cost

- Direct Labor Costs (Direct Labor Cost)

- Indirect Costs (Overhead Factory)

Commercial Expense (Operating Expense)

- Marketing and Selling Expense

- General & Administration Expense

Based on the accounting period

- Capital Expenditure (Capital Expenditure). These expenditures will benefit on some of the accounting period. This type of expenditure capitalize and list as the price of the acquisition. An expenditure is classify as a capital expenditure if the expenditure on this benefit more than one accounting period, the amount was relatively large, and this expenditure is its nature is not routine.

- Revenue Expenditure (Revenue Expenditure). These expenditures will benefit in the accounting period in which the expenditure occur. These expenses be a burden in the period, and are list in the income statement. An expenditure is classify as revenue expenditure if the expenditure benefit during the period of the occurrence of such expenses, the amount was relatively small, and generally this spending to its routine.

Based on the influence of Management towards the cost

- Costs Under Control (Controllable Cost). Is the cost of that directly can be affect by a certain level of managers within a certain period?

- The Cost of the Uncontrolled (Uncontrollable Cost). Is the cost of which cannot be influence by a Manager or a certain level of officials?

Characteristics of the Costs associate with the Output

- Engineer Cost. Are the costs of having links with an explicit physical output?

- Discretionary Costs. This fee is refer to as manage cost or programmed cost is a cost that does not have an accurate relationship with output.

- Costs or expenses Commit capacity. Are all costs that occur in order to maintain the capacity or ability of the organizations in the activities of production, marketing and administration.

The influence of changes in the Volume of activities towards the cost

- Fixed Costs. The fee amount is not affect by changes in the volume of activity until at some stage. Fixed cost per unit change inversely proportional to changes in the volume of activity.

- Variable Costs. The variable cost assumes the linear relationship between the cost of such activities. A variable costs i.e. costs which total amount is change. In proportion to the change in the volume of activities, the greater the volume of activity the greater number of total variable costs.

- Semi Variable Cost. The total amount of cost which change according to the changes in the volume of activities, but the nature of the change is not proportional/pro.

Based on the object finance

- Direct Costs. Costs or benefits can be identify to a particular cost center or object.

- Indirect Costs. The cost of the case or its benefits cannot be identify on the object or a particular cost center. Or the cost of the benefits enjoy by some object or cost center.

No comments:

Post a Comment